Understanding The Home Buying Process

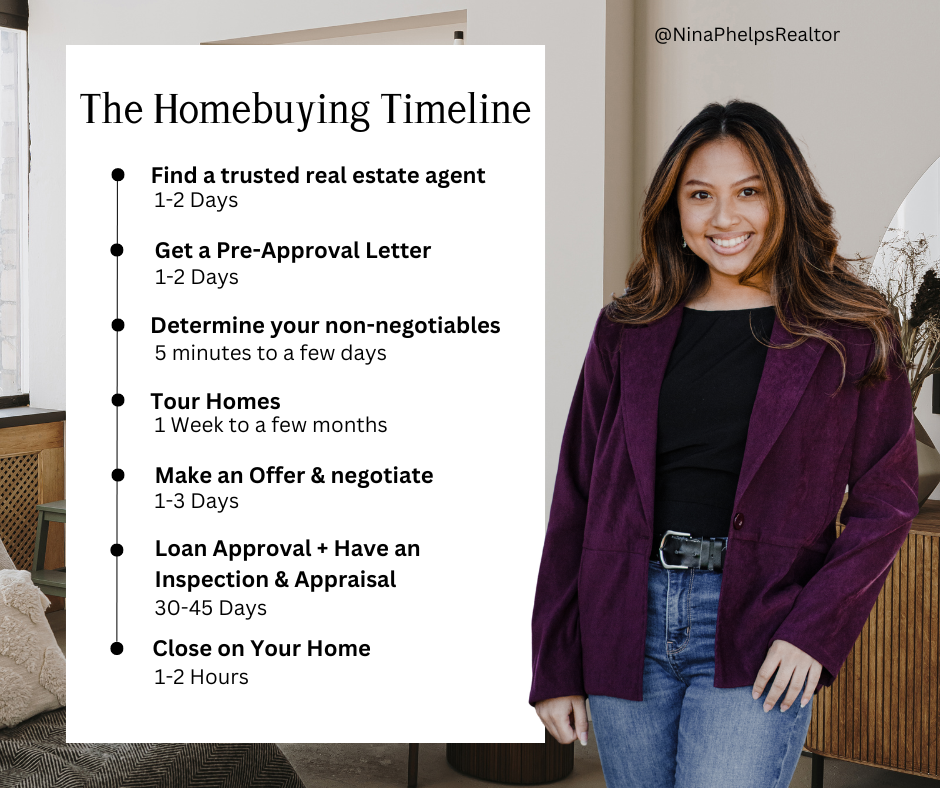

Purchasing a home is a major milestone, but it can also be a complex and time-consuming process. Understanding the home buying timeline is crucial for anyone looking to purchase a home, as it can help you to anticipate and prepare for each step of the process and to manage your expectations about how long the process may take.

Whether you’re a first-time homebuyer or an experienced homeowner looking to make a move, understanding the homebuying timeline is essential. The home buying process can vary depending on the specifics of the transaction, but generally, it includes the following steps:

Step 1: Find a Trusted Real Estate Agent

It is important to find a trusted real estate agent because they can play a crucial role in helping you buy or sell a property. A good agent will be able to guide you through the process, provide valuable advice, and represent your interests. They should also have a deep knowledge of the local real estate market and be able to help you find a property that meets your needs and budget.

Step 2: Get a Pre-Approval Letter

A pre-approval letter is a document issued by a lender indicating that you have been pre-approved for a mortgage up to a certain loan amount. It is an important step in the home buying process because it demonstrates to sellers that you are a serious and qualified buyer.

Having a pre-approval letter can give you an advantage when making an offer on a property, especially in a competitive market. Sellers are more likely to take your offer seriously if they know that you have already been pre-approved for a mortgage and are able to close the deal.

Overall, a pre-approval letter is an important step in the home buying process because it can help you to be a more competitive and qualified buyer, and it can give you a better understanding of your financial situation.

Step 3: Come Up With Your Non-Negotiables List

A non-negotiables list is a list of features or characteristics that are essential to you in a home and that you are unwilling to compromise on. It is an important tool to use when buying a home because it can help you to focus your search and make the process of finding a home more efficient.

Having a non-negotiables list can also help you to avoid wasting time looking at homes that do not meet your needs or that do not have the features that are important to you. For example, if you have a large family and need at least four bedrooms, you can use your non-negotiables list to eliminate homes that do not meet this requirement.

In addition to saving time, having a non-negotiables list can also help you to stay focused on your priorities and avoid getting swayed by homes that may have some attractive features but do not meet your most important criteria.

Step 4: Tour Homes

Your trusted real estate agent can help you to identify properties that meet your needs and budget and can schedule tours of the homes that you are interested in. This may take some time, depending on the type of home you are looking for, the location you want to live in, and what is on your non-negotiables list.

When touring homes with an agent, it is important to be open and honest about your needs, preferences, and budget. This will help your agent to show you homes that are a good fit for you and to provide you with useful advice.

Step 5: Make an Offer and Negotiate the Deal

Once you have found a home that you are interested in, you will need to negotiate the terms of the sale with the seller. This can include the purchase price, closing date, and any contingencies.

When making an offer, it is important to consider the following factors:

- The list price of the home: Your offer should be based on the list price of the home and should take into account any recent comparable sales in the area.

- Your budget: Make sure that your offer is within your budget and leaves room for closing costs, moving expenses, and any necessary repairs or renovations.

- The local market: Consider the current state of the local real estate market and how it may affect your offer. For example, if the market is hot and there are multiple offers on the home, you may need to be more aggressive with your offer.

Once you have made an offer, the seller may accept it, reject it, or make a counteroffer. If the seller makes a counteroffer, you will have the option to accept it, reject it, or make a counteroffer of your own.

Step 6: Under Contract

Get Your Loan Approved – This involves applying for a mortgage and working with a lender to secure financing for the purchase.

Order an Appraisal – An appraisal is typically required by a lender in order to ensure that the value of the property is sufficient to secure the mortgage.

Order an Inspection – You may choose to hire a professional home inspector to assess the condition of the property and identify any issues that need to be addressed. If the inspections reveal any issues with the property, the buyer may ask the seller to make repairs or provide credits to cover the cost of the repairs. The parties will negotiate any necessary repairs or credits and come to an agreement.

Step 7: Close on Your Home

The closing process for a home is the final step in the home buying process and involves completing all of the necessary paperwork and paying any closing costs and fees. The closing process typically takes place at the office of a title company or a lawyer’s office, and it is attended by the buyer, seller, and any necessary parties, such as real estate agents and mortgage lenders.

During the closing process, the following steps will typically take place:

- The buyer will review and sign the final closing documents, including the mortgage loan documents and the deed transferring ownership of the property.

- The buyer will pay any closing costs and fees, which may include things like mortgage points, title insurance, and property taxes.

- The seller will transfer ownership of the property to the buyer and provide any necessary keys and other access codes.

- The title company or lawyer will record the deed and other closing documents with the appropriate government agency and disburse any funds as required.

After the closing process is complete, the buyer becomes the official owner of the property and is responsible for paying the mortgage and maintaining the property.

In Conclusion

Understanding the home buying timeline can help you anticipate and prepare for each stage of the process, as well as manage your expectations about how long it will take. It can also assist you in identifying potential issues or delays and taking appropriate action to address them.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link